charge cards

Hard Time Choosing A Credit Card Company? Try These Tips!

Charge cards are usually associated with high interest rates and bad spending decisions. But, if you used properly and responsibly, a credit card can have its perks. Many enjoy the convenience of a credit line and benefit from their credit company’s reward programs. To find out what charge cards can do for you, continue reading this article for advice.

If you have two to three charge cards, it’s a great practice to maintain them well. This will help you build one’s credit score, particularly if you pay your bill in full. Do not over-do it. Having more than three charge cards can concern a lender looking at your credit report.

Keep careful record of your charges to be sure that you can afford what you spend. Unless you track your purchases, it’s easy to spend way too much.

Make it your goal to never pay late or over the limit fees. Both fees can be very pricey, both to your wallet and your credit report. Watch carefully, and do not go over your credit limit.

Set a fixed budget you can stick with. While your credit card limit may be ten or fifteen thousand dollars, that isn’t necessarily what you should spend. Only spend what you can afford so that you can pay the bill off at the end of the month.

Credit Card

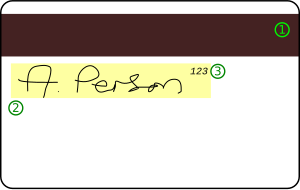

As soon as your credit card arrives in the mail, sign it. This will protect you should your credit card get stolen. Many vendors now require cashiers to verify signature matches so your card can be safe.

It may not be in your best interest to get your first credit card the moment you become old enough to do so. While this is what many people do, you need to get a few months of understanding the credit industry behind you before you go all out. Seek advice from someone you trust prior to getting a credit card.

Read any communication about your bank cards, whether online or in the mail, right away. Written notice is all that is required of credit card companies before they change your fees or interest rates. You have the right to cancel a credit card if you disagree with any changes.

Those people looking to acquire a new card should look for no annual fee, lower interest rates and lots of perks. There are many bank cards available with no annual fee, so choose one of these to save you money.

Don’t write your password or pin number down. You need to just remember what your password is so no one else can steal or use it. Recording the pin number, and keeping it where you keep your credit card, will provide any person with access if they desire.

Credit Card

Avoid the urge to lend a credit card to someone. You may trust your friend, but it can cause problems. It is never a good idea to let friends use your card. Doing so can cause over-limit charges when someone else charges more to the credit card than you said he could.

If you are called and asked for the number of your credit card, refuse to divulge it. Many scammers will use this ploy. Make it a point to only give your credit account number to trusted businesses when you have originated the call. Do not give them to people who call you. Regardless of who they say they are, you cannot be sure.

When used carefully, charge cards are very beneficial. From the peace of mind of having some flexibility and emergency space, to the possibility of racking up perks and rewards, the charge cards now or soon to be in your wallet can actually make your life a brighter one. Use the advice in this piece in order to achieve real success.

What To Look For When Getting A Credit Card

Credit cards will just be used more and more in the future. As banks raise fees for regular accounts and debit cards, many people are using only charge cards for storing money and making transactions. Keep reading to find out how to use charge cards wisely.

Don’t use cards to buy items you could never afford. If it is something that is going to cause you financial difficulty, you are better off avoiding the purchase.

If you have two to three charge cards, it’s a great practice to maintain them well. This will help you build one’s credit score, particularly if you pay your bill in full. However, if you have over three, a lender may think that looks bad when pulling up your personal credit bureau report.

Credit Card

If you notice a fraudulent charge on your credit card, report it immediately. If you do this immediately, you will help your credit card company catch the person who stole your credit card. This will help ensure you are not liable for any fraudulent charges against the card. The minute you notice a charge that could be fraud, an email or phone call to the credit card provider can commence the dispute process.

Whenever you can manage it, you should pay the full balance on your credit cards every month. Really, credit cards should be used for convenience, and the bills should be paid on time and in full. Using charge cards in this way improves your credit score and prevents you from having to pay finance charges.

Don’t put your pin or password to paper, no matter what the circumstances. Make sure you know your password so you ensure that only you have access to it. If you document your pin number, and keep it with your card, anyone can use it.

Ask the credit card company if they would consider lowering your interest rate. Sometimes, especially if you have a long and positive history as a customer, companies are willing to reduce their interest rates. It never hurts to ask, and you could possibly save a bundle!

Accounts Open

It is critical for you to keep a credit card account open for as long as possible once you have opened it. You should not switch credit accounts unless you find it completely unavoidable. The length of time you have had accounts open is an important factor in calculating your credit score. Building credit is in part about keeping accounts open when possible.

If you can, do not use your credit card at the grocery store or a restaurant. They take longer to appear on a statement, and you may not know your real available balance. This can lead to you spending more money since you will have the perception that your balance is actually lower than it is.

Bank cards are becoming more and more popular, as people are starting to turn away from debit cards, which can have large fees and restricting regulations. Thus, there are more opportunities for everyone to find a credit card offer that suits their needs. Maximize your benefits by using the tips that you have learned here.