charge cards

Don’t Know Much About Charge Cards? Read This

Customer advice itself is a commodity, especially when dealing with bank cards. This article includes many helpful suggestions for using credit and insights into the credit industry. The problem with most is that they have credit cards and lack the knowledge to use them prudently. Debt is the end result of this issue.

Avoid purchasing items out of your budget with a credit card. While credit can help you afford things you can pay off over a few months, avoid charging expensive items that you cannot pay off quickly.

If you receive a credit card offer in the mail, make sure you read all the information carefully before accepting. If there are offers that allow you to be pre-approved for a card or if the person is saying you can be helped to get a card, you have to know the details before signing up. Know the percent of your interest rate, as well as the length of time you will have to pay for it. You should be aware of any and all fees, and be aware of grace periods.

Bonus Offer

A lot of companies offer large bonuses for new customers. These bonuses are often conditional, though. You need to review all of the documentation that comes with a bonus offer thoroughly before you sign up. The one that comes up the most is that you’re supposed to spend a very certain amount in the next few months to qualify for the bonus offer.

You surely wish to steer clear of late charges as well as over limit fees. Both are expensive fees and exceeding your limit can also hurt your credit score. Pay attention and make sure you stay under your credit limit.

Be careful when using charge cards. Give yourself spending limits and only buy things that you know you can afford. Prior to choosing a credit card for buying something, be sure to pay off that charge when you get your statement. If you hold onto your balance, your debt will keep increasing, which will make it much more difficult for you to get everything paid off.

Credit cards are frequently tied to reward programs that can benefit the card holder quite a bit. You should find a rewards program that will benefit you for regular usage of your card. This can really help you to afford the things you want and need, if you use the card and rewards with some level of care.

As was mentioned in the beginning, charge cards can easily become a tool for getting into deep financial trouble. If you spend too much on too many cards, you will be in a tight spot. Hopefully, you can use what you went over in this article to help you use your credit card more wisely.

Helpful Information That’s Highly Effective When Using Credit Cards

When bank cards are good they are very good, but when they are bad they are evil. Like a lot of things, charge cards could be hard to manage if you do not have the right advice or knowledge. This guide contains a lot of tips for anyone who wants to learn more regarding charge cards.

If a fraudulent charge appears on the credit card, let the company know straightaway. Immediate action you take gives your credit card company an upper hand in catching the thief. It’s also the most efficient way to limit the liability you face for the incurred charges. The minute you notice a charge that could be fraud, an email or phone call to the credit card provider can commence the dispute process.

It is common for card issuers to offer big incentives for opening accounts. These bonuses are often conditional, though. You need to review all of the documentation that comes with a bonus offer thoroughly before you sign up. Frequently, you are required to charge significant sums on the card in a short time to qualify for the bonus. Be sure to understand those terms so you are not disappointed.

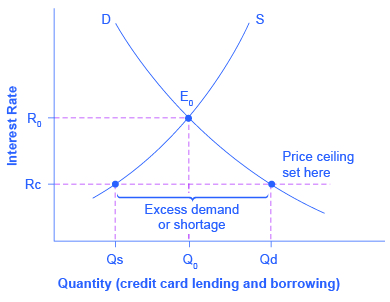

Interest Rate

Know the interest rate you are getting. If you are applying for a new credit card, make sure that you are aware of what the rate is on that card. When you do not understand the interest rate, you may end up paying more than what you bargained for. If you’re paying more, you may not be able to afford to pay off the debt each month.

Adhere to a smart budget. You do not need to spend the entire limit on your card, even though it’s available. Understand the amount you can realistically afford each month so that you will not incur interest charges.

Be sure you go over the terms that come with your credit card as carefully as possible prior to using it. Most companies think the first time you use their card constitutes accepting their terms. Although some of this agreement may be in fine print, it is very important to thoroughly read all sections.

Keep your credit in a good state if you would like to be eligible for the best charge cards. Credit card companies use these scores to figure out what card you are eligible for. People who maintain outstanding credit scores have access to charge cards that charge little interest, provide great rewards programs, and even offer cash back features.

Bank Cards

Again, many people get frustrated trying to understand bank cards and deal with them appropriately. However, the right advice can help you to get a grip on the way you use your cards. Apply this advice to improve the way you manage your bank cards.