annual fee

Ways You Can Get The Most Out Of Your Credit Cards

While there is a need for cash, credit card use is quickly increasing. Banks continue to increase all of their account fees, so more and more people are moving to credit. The article will provide you with helpful information about this growing field.

Many people wonder if it is better to have one credit card or many. For most people, it is best to have two or three credit cards open. This is especially helpful when building a good credit score, but remember these cards should be paid in full monthly. However, if you open more than three, it may not look good to a lender when they pull your credit bureau report.

Before opening a credit card, be sure to check if it charges an annual fee. Depending on the card, annual fees for platinum or other premium cards, can run between $100 and $1,000. If you do not need the perks associated with these cards, don’t pay the annual fee.

Always monitor your balance. Also make sure that you understand the limits placed on your credit cards. If you pass that limit, you will end up paying more in fees than you know. This will make it harder for you to reduce your debt if you continue to exceed your limit.

Use all of your bank cards in a wise way. Don’t buy anything that you know you can’t afford. When you use the card, you have to know when and how you are going to pay the debt down before you swipe, so that you do not carry a balance. If you can avoid carrying a balance over from month to month, you will remain in charge of your financial health.

Carefully read through all the conditions and terms of your card agreement before using the card. In most cases, using the credit card for the first time means you agree with all the terms. It may be fine print, but it is still very important.

Bank cards are often tied to different kinds of loyalty accounts. If you are going to use any kind of credit card with perks, find one that is of the most value to you. This can end up providing you with a source of extra income, if it is used wisely.

Read any communication about your charge cards, whether online or in the mail, right away. Credit companies can change their interest rates, fees and other account details, as long as the companies provide you with advance written notice. It is within your rights to cancel the card, if you don’t wish to agree to the changes.

Annual Fee

People searching for new credit cards should try and find one without an annual fee and with low interest rates. There are plenty of cards that don’t come with an annual fee, so getting one that does is foolish.

Never keep a written record of your pin number or password. Memorize your password, and never share it with anyone else. Writing the pin number down, and having it in the same place as your card, will give anyone access to it if they want it.

Keep contact information for credit card companies, your account number, and all other relevant data in a safe place that is easy for you to access. Keep this list in a safe place, like a safety deposit box, away from each of your bank cards. Use this list to contact your credit card issuers if your bank cards are ever lost or stolen.

It is commonly thought that high limits on credit cards should never exceed 3/4 of a consumer’s monthly pay. If you have credit limits that are more than you make every month, you need to start paying off that debt right away. If you do not or cannot, the amount of interest you pay quickly skyrockets to excessively high amounts.

Because many debit cards have been adding fees and strict regulations, charge cards are becoming a more popular form of payment. With the way that the credit card industry is expanding and involving, you can certainly take advantage of the available opportunities yourself. Use this article to improve your own knowledge.

Hard Time Choosing A Credit Card Company? Try These Tips!

Charge cards are usually associated with high interest rates and bad spending decisions. But, if you used properly and responsibly, a credit card can have its perks. Many enjoy the convenience of a credit line and benefit from their credit company’s reward programs. To find out what charge cards can do for you, continue reading this article for advice.

If you have two to three charge cards, it’s a great practice to maintain them well. This will help you build one’s credit score, particularly if you pay your bill in full. Do not over-do it. Having more than three charge cards can concern a lender looking at your credit report.

Keep careful record of your charges to be sure that you can afford what you spend. Unless you track your purchases, it’s easy to spend way too much.

Make it your goal to never pay late or over the limit fees. Both fees can be very pricey, both to your wallet and your credit report. Watch carefully, and do not go over your credit limit.

Set a fixed budget you can stick with. While your credit card limit may be ten or fifteen thousand dollars, that isn’t necessarily what you should spend. Only spend what you can afford so that you can pay the bill off at the end of the month.

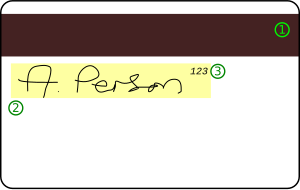

Credit Card

As soon as your credit card arrives in the mail, sign it. This will protect you should your credit card get stolen. Many vendors now require cashiers to verify signature matches so your card can be safe.

It may not be in your best interest to get your first credit card the moment you become old enough to do so. While this is what many people do, you need to get a few months of understanding the credit industry behind you before you go all out. Seek advice from someone you trust prior to getting a credit card.

Read any communication about your bank cards, whether online or in the mail, right away. Written notice is all that is required of credit card companies before they change your fees or interest rates. You have the right to cancel a credit card if you disagree with any changes.

Those people looking to acquire a new card should look for no annual fee, lower interest rates and lots of perks. There are many bank cards available with no annual fee, so choose one of these to save you money.

Don’t write your password or pin number down. You need to just remember what your password is so no one else can steal or use it. Recording the pin number, and keeping it where you keep your credit card, will provide any person with access if they desire.

Credit Card

Avoid the urge to lend a credit card to someone. You may trust your friend, but it can cause problems. It is never a good idea to let friends use your card. Doing so can cause over-limit charges when someone else charges more to the credit card than you said he could.

If you are called and asked for the number of your credit card, refuse to divulge it. Many scammers will use this ploy. Make it a point to only give your credit account number to trusted businesses when you have originated the call. Do not give them to people who call you. Regardless of who they say they are, you cannot be sure.

When used carefully, charge cards are very beneficial. From the peace of mind of having some flexibility and emergency space, to the possibility of racking up perks and rewards, the charge cards now or soon to be in your wallet can actually make your life a brighter one. Use the advice in this piece in order to achieve real success.