Easy Ways That You Could Do To Make The Most Out Of Your Charge Cards

Many people have despised credit cards since they were first invented. Like almost anything, it is hard to handle bank cards without being educated about them. Read on to find some great tips for anyone looking to expand their credit card knowledge.

Do not close any credit card accounts before you are aware of the impact it will have on you. Sometimes closing a card can have a negative affect on your credit, so you should avoid doing so. The card that makes up most of your financial history should not be closed.

Lots of credit card companies give bonuses for when you sign up for new bank cards. Be sure that you fully understand the fine print, though, because many of these cards have very specific terms that you must meet to qualify for the bonus. One of the most common terms is that you spend a set amount of money in a set period.

If you want a credit score that is good, be sure that you’re able to pay credit card payments before it’s due. Paying bills late can harm your credit, and cost a lot of money. To save time and trouble, consider signing up for an automatic payment plan. This will ensure you never pay late.

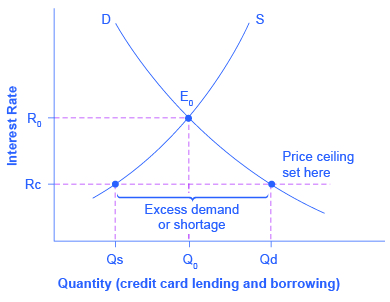

Always know what rate you are paying for interest. It is essential that you find out before you ever sign up for the card. You could be charged much more than you originally thought if you are not sure of the rate. If the interest rate is too high, you might find yourself carrying a bigger and bigger balance over each month.

Use your credit cards wisely. Limit your spending and only purchase things with your card that you can afford. Be sure you can immediately pay the bill when it comes prior to charging an item. A balance that is carried makes it easier to create a higher amount of debt and makes it more difficult to pay it off.

Credit Scores

Keeping your credit score healthy is the secret to landing a really good credit card. Different credit cards are offered to those with different credit scores. Those cards with the lowest of rates and the opportunity to earn cash back are given only to those with first class credit scores.

Those people looking to acquire a new card should look for no annual fee, lower interest rates and lots of perks. It doesn’t make sense to pay an annual fee when there are many bank cards that charge no fee.

Retain a copy of the receipt when you utilize your credit card online. Keep this receipt until you receive your bill to ensure the company that you bought from is charging you the right amount. If you were not charged the correct amount, contact the online retailer immediately to file a dispute. This can help you to be sure that you never overpay for the items that you purchase.

Credit Cards

Again, many people get frustrated trying to understand credit cards and deal with them appropriately. However, with the proper advice or tips, dealing with charge cards is way easier than you might expect. Implement the tips in this article and deal with your credit cards effectively.

Helpful Information That’s Highly Effective When Using Credit Cards

When bank cards are good they are very good, but when they are bad they are evil. Like a lot of things, charge cards could be hard to manage if you do not have the right advice or knowledge. This guide contains a lot of tips for anyone who wants to learn more regarding charge cards.

If a fraudulent charge appears on the credit card, let the company know straightaway. Immediate action you take gives your credit card company an upper hand in catching the thief. It’s also the most efficient way to limit the liability you face for the incurred charges. The minute you notice a charge that could be fraud, an email or phone call to the credit card provider can commence the dispute process.

It is common for card issuers to offer big incentives for opening accounts. These bonuses are often conditional, though. You need to review all of the documentation that comes with a bonus offer thoroughly before you sign up. Frequently, you are required to charge significant sums on the card in a short time to qualify for the bonus. Be sure to understand those terms so you are not disappointed.

Interest Rate

Know the interest rate you are getting. If you are applying for a new credit card, make sure that you are aware of what the rate is on that card. When you do not understand the interest rate, you may end up paying more than what you bargained for. If you’re paying more, you may not be able to afford to pay off the debt each month.

Adhere to a smart budget. You do not need to spend the entire limit on your card, even though it’s available. Understand the amount you can realistically afford each month so that you will not incur interest charges.

Be sure you go over the terms that come with your credit card as carefully as possible prior to using it. Most companies think the first time you use their card constitutes accepting their terms. Although some of this agreement may be in fine print, it is very important to thoroughly read all sections.

Keep your credit in a good state if you would like to be eligible for the best charge cards. Credit card companies use these scores to figure out what card you are eligible for. People who maintain outstanding credit scores have access to charge cards that charge little interest, provide great rewards programs, and even offer cash back features.

Bank Cards

Again, many people get frustrated trying to understand bank cards and deal with them appropriately. However, the right advice can help you to get a grip on the way you use your cards. Apply this advice to improve the way you manage your bank cards.